The sales revenue of the Volkswagen, Škoda, SEAT/Cupra and Volkswagen Commercial Vehicles brands rose significantly in the first quarter of 2025, totaling some 35.3 billion euros. There was strong growth in deliveries of all-electric models. At the same time, provisions in connection with CO₂ regulations in Europe as well as the diesel issue impacted the operating result, which decreased to 1.12 billion euros in the first quarter. Inventory write-downs in connection with the import duties announced by the United States also had an adverse effect on the result.

“The Brand Group Core held its own in a challenging first quarter with increases in unit sales and sales revenue. Convincing market launches and higher deliveries of all-electric models acted as a counterbalance to negative external factors.

These external challenges show that we must keep up the vigorous pursuit of our performance programs in the brands. We continue to work on lowering battery costs, reducing factory costs and overheads, shortening development times, and improving software quality. This is how we are strengthening the resilience and competitiveness of our Brand Group Core.”

David Powels, Member of the Board of Management of the Volkswagen Brand responsible for “Finance” and responsible for Finance at the Brand Group Core

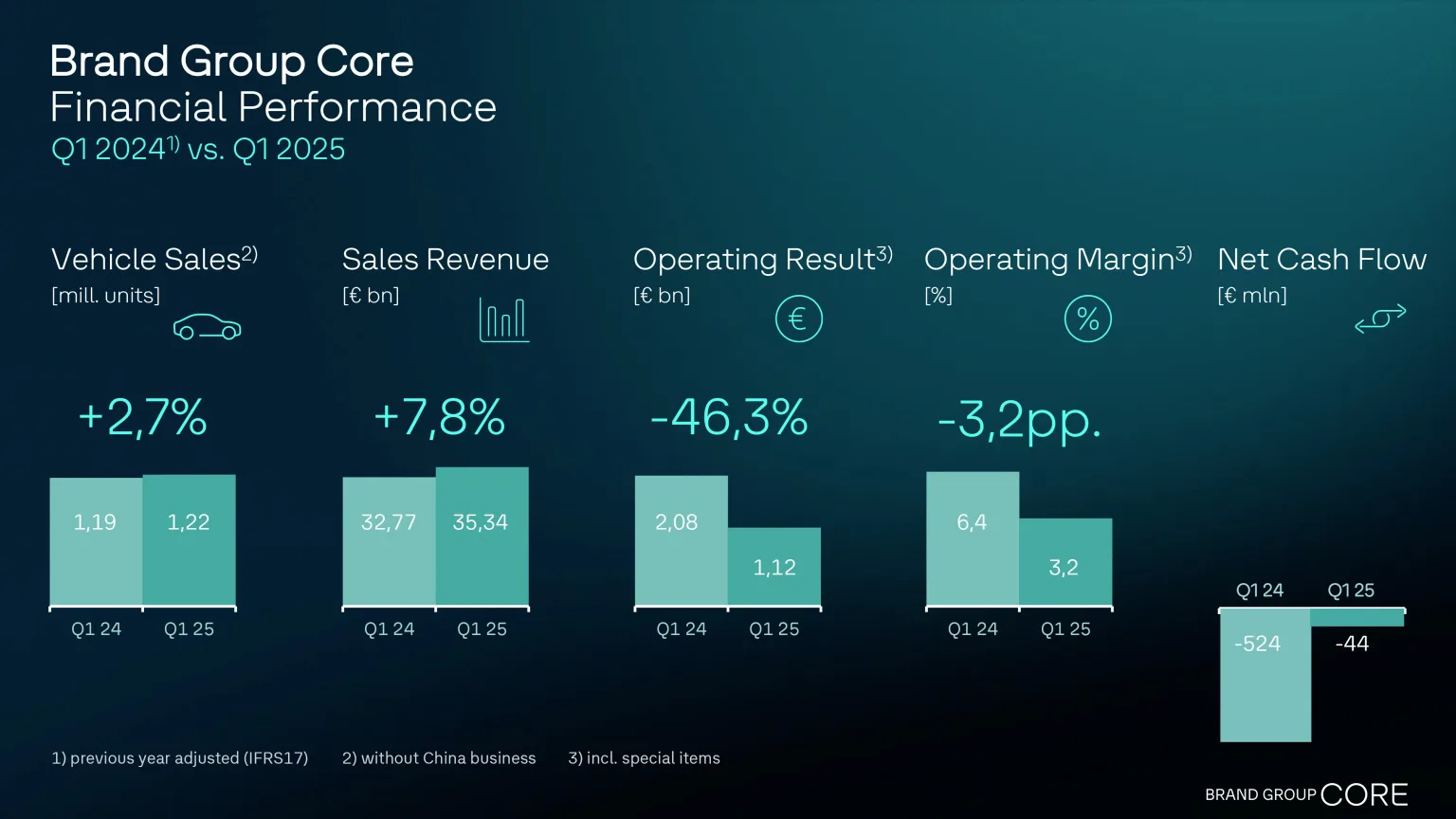

| Unit sales rose to 1.22 million (1.19 million vehicles in Q1 2024)Sales revenue improved significantly to 35.34 billion euros (32.77 billion euros in Q1 2024) | Unit sales grew 2.7% year-on-year. Strong share of BEV models impacted margins. Overall, the Core brands won market share.Brand Group Core sales revenue improved significantly in an intensely competitive environment, with 7.8% growth on the back of higher volume and mix effects for the Volkswagen und Škoda brands. | |

| Operating result came in at 1.12 billion euros (2.08 billion euros in Q1 2024) | In addition to litigation costs relating to the diesel issue, provisions in connection with current CO2 regulations in Europe had an adverse effect on the result. | |

| Operating margin of 3.2% (6.4% in Q1 2024) | Expenses from inventory write-downs of vehicles in transit due to import duties announced by the United States from April 2025 negatively affected the operating return. | |

| 480 million euro improvement in net cash flow to -44 million euros (-524 million euros in Q1 2024) | Cash flow improved by 480 million euros year-on-year due to the decrease in vehicles inventories and targeted investments. |

Review Q1 / 2025

The Brand Group Core recorded successful market launches and a significant rise in the sale of all-electric models in the first quarter of 2025, thereby demonstrating its strength and adaptability in a highly demanding market environment.

The successful introduction of new models such as the Volkswagen Tayron and the Škoda Elroq further strengthened the portfolio and underscored the brands’ ability to serve customers’ needs and requirements.

Overall, the start to the year was influenced by the negative effects of CO2 regulations in Europe, import duties in the United States, and costs relating to the diesel issue.

Outlook

Despite the present challenges, the Brand Group Core is steadily growing closer together – in the coming years, the brand group will focus on consistently increasing efficiency by expanding cooperation in jointly-agreed strategic fields of action.

Going forward, the brand group’s global production network of 22 locations will be organized in five production regions with a view to fostering stronger networking. Production will be more efficient and future-oriented, and cross-brand synergies and regional cost advantages will be leveraged.

The number of country clusters for technical development will also be reduced across all brands. Market requirements and customer wishes will be taken into account more effectively and efficiently in future. Furthermore, development times for new vehicles will be shortened to enable a faster response to market changes.

Cooperation among the volume brands on the “Electric Urban Car Family” project is proceeding as planned. Under the project led by Seat/CUPRA, the Brand Group Core will be launching electric cars in the 25,000-euro class from 2026. The four planned models – two from the Volkswagen brand and one each from CUPRA and Škoda – will be built at the Spanish plants in Martorell and Pamplona. Collaboration on the “Electric Urban Car Family” project alone will unlock synergy potential at brand group level totaling 650 million euros across the entire product life cycle.

The “Zukunft Volkswagen” program agreed at the end of last year laid the foundation for the competitiveness of Volkswagen AG in Germany. The program combines economic stability and sustainable employment. It paves the way for the Volkswagen brand as the main pillar of the Brand Group Core to become the global technologically leading volume manufacturer by 2030.

That is why the Brand Group Core is targeting continuous increases in earnings in the coming years, underpinned by the effects of the ongoing performance programs at all volume brands. Intensive efforts are already underway to implement the measures that have been decided – and thus generate a pathway to a medium-term return on sales of 8% for the Brand Group Core.

Overview of the brands in the Brand Group Core

Volkswagen Passenger Cars

Volkswagen Passenger Cars delivered 726,267 vehicles (excluding China, including external manufacturing) in the first quarter of 2025, a year-on-year increase of 4.6%. This trend was in part attributable to an upswing in sales of the ID.4, ID.7, T-Cross and Tiguan and the successful market launch of the Tayron. Sales revenue ran at 21.2 billion euros, an increase of 10.2% over the comparable prior-year period. The operating result fell by 84.9% to 112 million euros, with the decrease especially attributable to special items. In particular, provisions in connection with CO2 regulations in Europe had a negative impact on the result. Other adverse factors were litigation costs in connection with the diesel issue and expenses from the measurement of vehicles in transit due to import duties introduced in the United States from the beginning of April. As a result, the operating margin of the Volkswagen brand fell significantly to 0.5% compared with 3.9% in the previous year.

“We began the year with a strong, rejuvenated product offering and the positive dynamic continues with the high order intake. However, counter-effects mean our Q1 results are not satisfactory. The continued implementation of our performance program and the “Zukunft Volkswagen” agreement, together with our present product substance, will enable us to meet our return target of 4% in 2025.”

David Powels, Member of the Board of Management of the Volkswagen Brand responsible for Financeand responsible for Finance at the Brand Group Core

Škoda Auto

In the first quarter of 2025, Škoda Auto Group was able to build on the successes of the 2024 financial year– the best ever in its history. Škoda delivered 238,600 vehicles in Q1 2025, an increase of 8.2% compared with the same prior-year period. At 36,900 units, deliveries of all-electric and plug-in hybrid models more than doubled. Driven by higher demand, the broad and modern model range and consistent cost optimization under the Next Level Efficiency+ program, the brand generated sales revenue of 7.259 billion euros (+10.4%). The operating result increased to 546 million euros, with a stable operating margin of 7.5%.

“Škoda Auto built on its 2024 performance – the most successful financial year ever – with a strong first quarter in 2025. This was in particular attributable to continued high demand for our products and our focus on systematic cost efficiency. At the same time, we are benefiting from our balanced model portfolio of efficient ICEs, optimized plug-in hybrids and all-electric vehicles, the implementation of AI projects, and existing synergies within the Brand Group Core. We remain committed to our goal to drive the transformation of the automotive industry towards e-mobility – within our brand, our home market of the Czech Republic, within Europe, and further afield. That is why we are making every effort to secure a solid basis for future investments, so that we can help our company become even stronger.”

Holger Peters, Board Member for Finance, IT and Legal Affairs, ŠKODA Auto

SEAT/CUPRA

SEAT S.A. generated sales revenue of 3.895 billion euros in Q1/25, 2.4&% higher than Q1/24 (3.803 billion euros). At the same time, SEAT S.A. reported an operating result of 5 million euros in Q1/25, a decrease of 221 million euros compared to the same prior-year period (Q1 2024: 226 million euros). This decrease is due to several factors, e.g. a shift in the sales mix towards BEV models, and European import duties on the CUPRA Tavascan produced in China. Further pressure came from a complex global environment and more intense competition, in particular on key markets for BEV models. The operating margin dropped to 0.1 %, a decrease of 5.8 percentage points compared with Q1 2024.

“We expected an exceptionally challenging environment and competitive situation in 2025 that calls for flexibility and agility in order to meet our targets. In the coming months we will continue to concentrate on the margin quality of our electric vehicles, while at the same time driving our cost control programs forward. We will continue to work on positioning SEAT S.A. as an even more sustainable and profitable company by concentrating on our strategic priorities.”

Patrik Andreas Mayer, Executive Vice-President for Finance and IT, SEAT/Cupra

Volkswagen Commercial Vehicles

Volkswagen Commercial Vehicles (VWN) delivered 108,721 vehicles in the first quarter of 2025 – a decrease of 10.8% compared with the same prior-year period. This was chiefly attributable to the planned model changeover to the new Transporter, that has now joined the Multivan and the ID. Buzz to complete the “Bus Trio”. At 4.1 billion euros, sales revenue was similar to the prior-year level (-0.,8%). The operating result fell by 91% to 37 million euros. The operating margin was 0.9%, 8.6 percentage points lower than the prior-year value.

“Our first quarter unit sales – particularly for the ID. Buzz – are in line with, and indeed sometimes above, our planning corridor. Following on from the generational change in the T models, the new Transporter and Caravelle debut as planned in 2025. The production runout of the T6.1 triggered exceptionally high demand last year. Given the good order intake situation, we remain positive about the coming months. The drop in operating result in the first quarter is largely attributable to new model ramp ups, a more competitive environment and provisions in connection with CO2 fleet regulations in Europe.”

Michael Obrowski, Board Member for Finance and IT, Volkswagen Commercial Vehicles

Key figures for the Brand Group Core:

| Key financials | Q1 2025 | Q1 2024 | Change25 /24 |

| Unit sales (thousand units; incl. external manufacturing) | 1,224 | 1,192 | 2.7% |

| Sales revenue | 35,340 million € | 32,773 million € | 7.8% |

| Operating result | 1,118 million € | 2,082 million euro | -46.3% |

| Operating margin | 3.2% | 6.4% | -3.2%-points |

| Net cash flow | -44 million € | -524 million € |

Key figures for the brands belonging to the Brand Group Core:

| Unit sales | Sales revenue | Operating result | Operating margin | |||||

| 1000 units/mill € | Q1 25 | Q1 24 | Q125 | Q124 | Q1 25 | Q1 24 | Q125 | Q124 |

| Volkswagen Passenger Cars | 726,267 | 694,617 | 21,226 | 19,264 | 112 | 746 | 0.5% | 3.9% |

| Škoda Auto | 276,245 | 268,400 | 7,259 | 6,574 | 546 | 535 | 7.5% | 8.1% |

| SEAT/CUPRA | 158,.238 | 164,318 | 3,895 | 3,803 | 5 | 226 | 0.1% | 5.9% |

| Volkswagen Commercial Vehicles | 108,721 | 121,906 | 4,138 | 4,170 | 37 | 398 | 0.9% | 9.5% |