The Volkswagen Group has published its financial results for the first quarter of 2025.

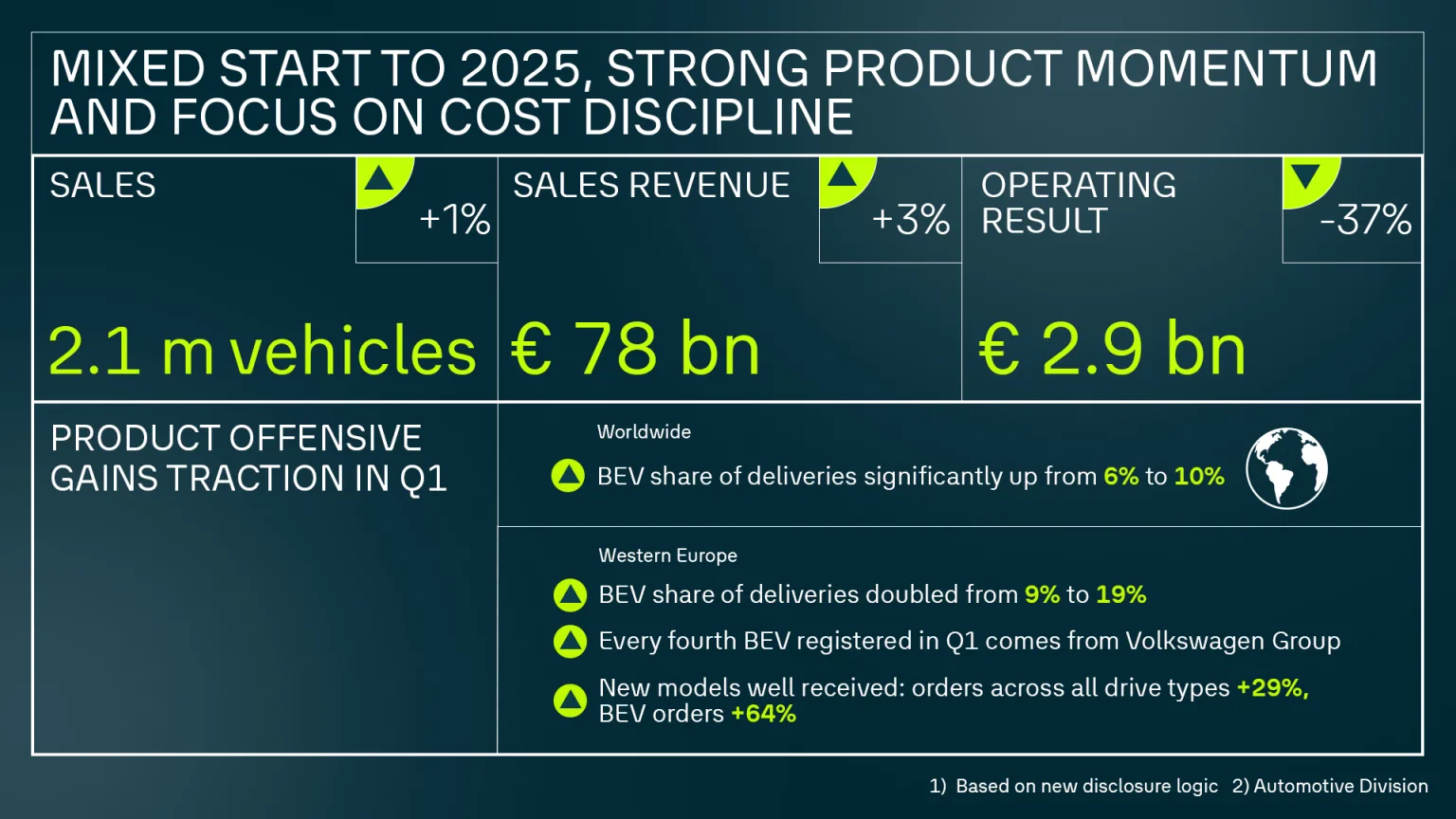

As expected, the Volkswagen Group experienced a mixed start to the fiscal year. Our cars are very well received. Order intake in Western Europe increased significantly and our order books are filling up fast. In addition, every fifth car sold in Western Europe is now fully electric with unit sales in Q1 more than doubling. At the same time, this market success of our electric cars puts pressure on our result. An operating margin of around four percent clearly shows that there is still a considerable amount of work ahead of us. Given the current volatile global economic situation, it is even more important to focus on the levers within our control. This means complementing our great product range with a competitive cost base – so we can ensure to succeed also in rapidly changing global markets.”

Arno AntlitzCFO & COO Volkswagen Group

Key Figures

| 77.6 billion EUR sales revenue in Q1 2025, up 2.8% from Q1 2024 (EUR 75.5 billion) | Group sales up 3% due to higher vehicle sales in markets outside China. Revenue growth in Brand Group Core, Brand Group Progressive and in the Financial Services business. This increase was slowed by a decline in revenue at Brand Group Sport Luxury and TRATON due to lower unit sales. |

| 2.9 billion EUR Operating Result in Q1 2025, below Q1 2024 (EUR 4.6 billion); Operating Margin of 3.7% | Operating Result impacted by slightly negative price/mix effects, higher fixed costs and particularly special effects of approx. EUR 1.1 billion. Adjusted for special effects, the Operating Result was around EUR 4.0 billion and the operating margin stood at 5.1%. |

| -0.8 billion EUR Net Cash Flow in the Automotive Division in Q1 2025 (EUR -2.5 billion) | Net cash flow in Q1 2025 negative, but above the previous year. Net Cash Flow was impacted by EUR 0.7 billion for M&A and EUR 0.5 billion cash-out related to restructuring measures. |

| 2.1 million vehicle sales in Q1 2025, 0.9% above Q1 2024 (2.1 million) | Unit sales growth in Europe (+4%) and South America (+17%) more than offset the slight decline in North America (-2%) and the expected decline in China (-6%). |

| +29% order intake for vehicles in Western Europe in Q1 2025 compared to the previous year | Strong demand for new models across all drive types, such as the VW ID.7 Tourer, CUPRA Terramar, Skoda Elroq, Audi Q6 e-tron, and Porsche 911. Order backlog in Western Europe increases to almost 1 million vehicles in the first three months, with orders for fully electric vehicles rising particularly sharply (+64%) and accounting for more than 20% of the total order book. |

Outlook for 2025

The Volkswagen Group expects the sales revenue to exceed the previous year’s figure by up to 5 percent. The operating return on sales for the Group is expected to be between 5.5 and 6.5 percent. This does not include any impact from tariffs recently announced.

In the Automotive Division, the Group expects an investment ratio between 12.0 and 13.0 percent in 2025. The automotive net cash flow for 2025 is expected to be between EUR 2.0 and EUR 5.0 billion. This includes cash outflows for investments for the future as well as for restructuring measures from 2024. Net liquidity in the Automotive Division in 2025 is expected to be between EUR 34 and EUR 37 billion.

Based on the developments in the period up to April 28, 2025, the Volkswagen Group expects the operating return on sales, automotive net cash flow and net liquidity to trend towards the lower end of the respective ranges.

Challenges will arise in particular from an environment characterized by political uncertainty, increasing trade restrictions and geopolitical tensions, the increasing intensity of competition, volatile commodity, energy and foreign exchange markets, and more stringent emissions-related requirements.

Note: Adjustments to the reporting logic from January 2025 will lead, among other things, to a more precise disclosure of the Automotive Division’s sales revenue. In mathematical terms, this will lead to a lower investment ratio, namely by 130 basis points to 13.0 percent in the 2024 financial year. Based on the adjusted reporting logic, we expect the investment ratio in the Automotive Division to reduce to between 12 and 13 percent in 2025 and to around 10 percent in 2027. For details, see page 180 of the 2024 Annual Report.