- Total deliveries increase by 12 percent to 9.24 million vehicles (2022: 8.26)

- Growth across all major brands and all regions

- Main drivers are Europe (+19.7 percent) and North America (+17.9 percent), China up despite challenging market environment (+1.6 percent)

- All-electric vehicles (BEV) increase by 34.7 percent to 771,100 (2022: 572,500)

- BEV share of total deliveries rises to 8.3 percent (2022: 6.9)

The Volkswagen Group increased its deliveries in 2023 by 12 percent to 9.24 million vehicles. All regions contributed to this growth, with Europe (+19.7 percent) and North America (+17.9 percent) being the main drivers. China, the Group’s largest single market, grew by 1.6 percent despite a challenging market environment. The Volkswagen Group expanded its market share in Europe as well as North and South America and thus also increased slightly worldwide.

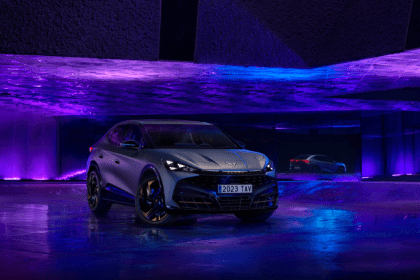

Almost all brands recorded growth, in some cases substantial. SEAT/CUPRA achieved the highest increase in the passenger car segment with a rise of 34.6 percent, while MAN led the way in the truck segment with an increase of 37.1 percent. At the same time, the Volkswagen Group successfully continued its transformation and delivered 771,100 fully electric vehicles. This corresponds to an increase of 34.7 percent compared to the previous year. The share of all-electric vehicles in deliveries rose to 8.3 percent compared to 6.9 percent in 2022.

“We are pleased with the market success of our strong brands and models. It is positive that all major brands and all regions are growing. We are resolutely driving forward the transformation. In 2023, we delivered 35 percent more all-electric vehicles to customers. We are also well positioned this year with numerous attractive new products despite ongoing challenges”, says Oliver Blume, CEO of the Volkswagen Group.

Hildegard Wortmann, Member of the Group’s Extended Executive Committee for Sales, adds: “We achieved a solid delivery performance last year given the geopolitical and macroeconomic situation. We grew faster than the total market and slightly extended our global market share. We would like to thank our customers and retail partners as well as the entire global team for this success.”

Deliveries in the regions developed as follows in 2023:

In Europe, deliveries rose particularly sharply by 19.7 percent to 3,774,500 vehicles. Of these, 472,400 vehicles had an all-electric drive, an increase of 34.2 percent compared to the previous year. The BEV share of total deliveries thus rose to 12.5 percent after 11.2 percent in 2022. The Group was once again the BEV market leader and gained market share in this segment.

In Western Europe, growth was even more pronounced at 20.6 percent. Here, 3,271,000 customers took delivery of a Group brand vehicle. In Germany, the Volkswagen Group’s home market, deliveries rose by 15.1 percent to 1,185,100 vehicles. In Central and Eastern Europe, 503,500 vehicles were handed over which corresponds to a growth of 13.9 percent.

In North America, the Volkswagen Group also significantly increased its deliveries by 17.9 percent to 993,100 vehicles. At 713,100 vehicles, the USA accounted for the largest share. This corresponds to an increase of 13.0 percent compared to the previous year. All-electric models were also an important growth driver here, increasing by 60.8 percent to 71,000 vehicles. The BEV share of deliveries thus rose to 10.0 percent after 7.0 percent in the previous year.

In South America, the Group handed over 9.4 percent more cars to customers than in the previous year, a total of 518,200 vehicles. A major contribution to this was made by Brazil, where 398,300 models were delivered. This corresponds to an increase of 18.0 percent compared to the previous year.

The Asia-Pacific region recorded an overall increase in deliveries of 2.3 percent to 3,594,500 vehicles.

In its largest single market, China, the Group achieved growth of 1.6 percent to 3,236,100 vehicles despite a challenging market environment. The all-electric models were also a growth driver here, increasing by 23.2 percent to 191,800 vehicles. The BEV share of deliveries thus reached 5.9 percent after 4.9 percent in the previous year. A total of 75,700 Volkswagen ID.3 vehicles were handed over to customers, making it one of the best-selling all-electric models in the world’s largest automotive market. A total of 61,700 Volkswagen ID.4 vehicles were delivered there, making it one of the top 5 electric compact SUV models.

The most successful all-electric Group models worldwide in 2023:

Volkswagen ID.4/ID.5 – 223,100

Volkswagen ID.3 – 140,800

Audi Q4 e-tron (incl. Sportback) – 111,700

ŠKODA Enyaq iV (incl. Coupé) – 81,700

Audi Q8 e-tron (incl. Sportback) – 49,000

CUPRA Born – 45,300

Porsche Taycan (incl. Turismo) – 40,600

Volkswagen ID. Buzz (incl. Cargo) – 28,600

In 2024, the Volkswagen Group will launch numerous attractive new models on the market, including many all-electric vehicles such as the Volkswagen ID.7 Tourer and the ID. Buzz with long wheelbase, the CUPRA Tavascan, the Audi Q6 e-tron and the Porsche e-Macan.

Volkswagen Group – Deliveries all drivetrains

| Deliveries to customers by market | Dec. 2023 | Dec. 2022 | Delta (%) | Oct. – Dec. 2023 | Oct. – Dec. 2022 | Delta (%) | Jan. – Dec. 2023 | Jan. – Dec. 2022 | Delta (%) |

| Western Europe | 288,600 | 277,200 | +4.1 | 828,400 | 754,300 | +9.8 | 3,271,000 | 2,711,300 | +20.6 |

| Central and Eastern Europe | 47,200 | 37,200 | +26.9 | 128,600 | 109,600 | +17.4 | 503,500 | 441,900 | +13.9 |

| North America | 95,300 | 77,600 | +22.8 | 277,000 | 211,400 | +31.1 | 993,100 | 842,600 | +17.9 |

| South America | 57,700 | 48,900 | +18.1 | 152,500 | 136,100 | +12.0 | 518,200 | 473,700 | +9.4 |

| China | 374,100 | 338,900 | +10.4 | 947,000 | 825,800 | +14.7 | 3,236,100 | 3,184,500 | +1.6 |

| Rest Asia-Pacific | 34,800 | 35,100 | -0.8 | 95,600 | 94,000 | +1.8 | 358,400 | 329,500 | +8.8 |

| Middle East/Africa | 36,400 | 27,400 | +32.8 | 95,000 | 75,200 | +26.2 | 359,300 | 279,300 | +28.6 |

| World | 934,300 | 842,300 | +10.9 | 2,524,100 | 2,206,400 | +14.4 | 9,239,500 | 8,262,800 | +11.8 |

| Deliveries to customers by brand | Dec. 2023 | Dec. 2022 | Delta (%) | Oct – Dec 2023 | Oct – Dec 2022 | Delta (%) | Jan. – Dec. 2023 | Jan. – Dec. 2022 | Delta (%) |

| Brand Group Core | 688,600 | 615,700 | +11.8 | 1,843,400 | 1,603,300 | +15.0 | 6,662,200 | 6,008,800 | +10.9 |

| Volkswagen Passenger Cars | 525,500 | 480,300 | +9.4 | 1,382,600 | 1,228,800 | +12.5 | 4,866,800 | 4,563,300 | +6.7 |

| ŠKODA | 77,300 | 66,500 | +16.3 | 224,600 | 186,700 | +20.3 | 866,800 | 731,300 | +18.5 |

| SEAT/CUPRA | 47,200 | 34,100 | +38.5 | 127,300 | 93,600 | +36.0 | 519,200 | 385,600 | +34.6 |

| VolkswagenCommercial Vehicles | 38,500 | 34,800 | +10.5 | 108,900 | 94,200 | +15.6 | 409,400 | 328,600 | +24.6 |

| Brand Group Progressive | 188,700 | 156,900 | +20.3 | 514,500 | 426,400 | +20.7 | 1,918,900 | 1,638,600 | +17.1 |

| Audi | 186,500 | 154,800 | +20.5 | 508,600 | 420,700 | +20.9 | 1,895,200 | 1,614,200 | +17.4 |

| Lamborghini/Bentley | 2,200 | 2,100 | +6.9 | 5,900 | 5,700 | +3.8 | 23,700 | 24,400 | -3.0 |

| Brand Group Sport Luxury | 26,300 | 37,200 | -29.4 | 77,500 | 88,400 | -12.3 | 320,200 | 309,900 | +3.3 |

| Porsche | 26,300 | 37,200 | -29.4 | 77,500 | 88,400 | -12.3 | 320,200 | 309,900 | +3.3 |

| Brand Group Trucks | 30,700 | 32,500 | -5.3 | 88,700 | 88,300 | +0.4 | 338,200 | 305,500 | +10.7 |

| MAN | 10,800 | 10,700 | +0.5 | 31,700 | 28,600 | +10.6 | 115,700 | 84,400 | +37.1 |

| VolkswagenTruck & Bus | 2,100 | 2,900 | -28.9 | 7,400 | 10,900 | -31.9 | 37,100 | 54,000 | -31.3 |

| Scania | 10,500 | 10,300 | +1.6 | 28,900 | 26,800 | +7.7 | 96,600 | 85,200 | +13.3 |

| Navistar | 7,400 | 8,600 | -12.9 | 20,700 | 22,000 | -5.8 | 88,900 | 81,900 | +8.5 |

| Volkswagen Group (total) | 934,300 | 842,300 | +10.9 | 2,524,100 | 2,206,400 | +14.4 | 9,239,500 | 8,262,800 | +11.8 |

Volkswagen Group – Deliveries battery-electric vehicles (BEVs)

| Deliveries to customers by market | Oct. – Dec. 2023 | Oct. – Dec. 2022 | Delta (%) | Jul. – Dec. 2023 | Jul. – Dec. 2022 | Delta (%) | Jan. – Dec. 2023 | Jan. – Dec. 2022 | Delta (%) |

| Europe | 131,300 | 140,200 | -6.3 | 255,300 | 223,200 | +14.3 | 472,400 | 352,100 | +34.2 |

| USA | 20,800 | 15,200 | +36.3 | 41,300 | 27,200 | +51.6 | 71,000 | 44,200 | +60.8 |

| China | 74,700 | 43,000 | +73.6 | 129,400 | 92,300 | +40.2 | 191,800 | 155,700 | +23.2 |

| Rest of the world | 12,700 | 7,400 | +71.7 | 23,500 | 12,500 | +88.0 | 35,800 | 20,400 | +75.3 |

| World | 239,500 | 205,900 | +16.3 | 449,500 | 355,200 | +26.5 | 771,100 | 572,500 | +34.7 |

| Deliveries to customers by brand | Oct. – Dec. 2023 | Oct. – Dec. 2022 | Delta (%) | Jul. – Dec. 2023 | Jul. – Dec. 2022 | Delta (%) | Jan. – Dec. 2023 | Jan. – Dec. 2022 | Delta (%) |

| Brand Group Core | 170,500 | 154,400 | +10.4 | 322,600 | 270,300 | +19.4 | 549,900 | 417,700 | +31.6 |

| Volkswagen Passenger Cars | 120,600 | 118,000 | +2.2 | 228,900 | 209,200 | +9.4 | 393,700 | 325,100 | +21.1 |

| ŠKODA | 27,200 | 16,800 | +62.0 | 50,300 | 31,500 | +59.9 | 81,700 | 53,700 | +52.1 |

| SEAT/CUPRA | 13,000 | 13,800 | -6.2 | 26,400 | 23,200 | +14.2 | 45,300 | 31,400 | +44.3 |

| VolkswagenCommercial Vehicles | 9,600 | 5,800 | +66.1 | 16,900 | 6,400 | +163.8 | 29,300 | 7,500 | +288.0 |

| Brand Group Progressive | 55,400 | 41,200 | +34.4 | 102,800 | 68,200 | +50.8 | 178,400 | 118,200 | +51.0 |

| Audi | 55,400 | 41,200 | +34.4 | 102,800 | 68,200 | +50.8 | 178,400 | 118,200 | +51.0 |

| Lamborghini/Bentley | – | – | – | – | – | – | – | – | – |

| Brand Group Sport Luxury | 12,700 | 9,700 | +31.0 | 22,600 | 15,900 | +42.2 | 40,600 | 34,800 | +16.7 |

| Porsche | 12,700 | 9,700 | +31.0 | 22,600 | 15,900 | +42.2 | 40,600 | 34,800 | +16.7 |

| Brand Group Trucks | 900 | 500 | +87.1 | 1,400 | 900 | +60.7 | 2,100 | 1,700 | +20.4 |

| MAN | 410 | 260 | +62.4 | 690 | 420 | +62.7 | 1,090 | 960 | +13.0 |

| VolkswagenTruck & Bus | 50 | 70 | -20.0 | 60 | 150 | -61.2 | 90 | 250 | -62.8 |

| Scania | 60 | 120 | -50.4 | 100 | 170 | -41.6 | 250 | 260 | -6.1 |

| Navistar | 390 | 50 | +625.9 | 600 | 160 | +282.2 | 670 | 270 | +150.9 |

| Volkswagen Group(total) | 239,500 | 205,900 | +16.3 | 449,500 | 355,200 | +26.5 | 771,100 | 572,500 | +34.7 |