- Commercial Recovery Efforts Drive Initial Rebound in EU30 Market Share vs. H2 2024, Stabilization in U.S. Retail Share

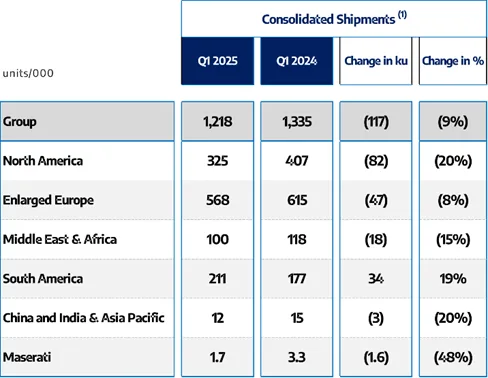

Stellantis N.V. has published global quarterly consolidated shipment estimates and provided commentary on related business trends. The term “shipments” describes the volume of vehicles delivered to dealers, distributors, or directly from the Company to retail and fleet customers, which drive revenue recognition.

Consolidated shipments for the three months ending March 31, 2025, were an estimated 1.2 million units, representing a 9% decline y-o-y, primarily reflecting lower North American production as a consequence of extended holiday downtime in January, and in Enlarged Europe due to the impacts of product transitions and lower light commercial vehicle (LCV) volumes.

Commercial progress in the first quarter of 2025, included the launch of all new and refreshed models including the Citroën C3 Aircross, Opel Frontera, Fiat Grande Panda, Ram 2500 and 3500 heavy-duty trucks, helping to drive positive momentum in order intake, while maintaining normalized dealer inventory levels.

- In North America, Q1 shipments declined approximately 82 thousand units compared to the same period in 2024, representing a 20% y-o-y decline, mainly reflecting lower January production, a consequence of extended holiday downtime, as well as the initial ramp up of the updated 2025 Ram heavy duty trucks. Looking at U.S. sales performance, Jeep® Compass, Grand Cherokee and Ram 1500/2500 each saw volumes rise >10% y-o-y in Q1 2025. Also encouraging, March new retail orders were at the highest level since July 2023.

- Enlarged Europe Q1 shipments declined approximately 47 thousand units, representing a 8% y-o-y decline, two-thirds due to transition gaps in certain A and B-segment vehicles replacing prior-generation products discontinued at the end of H1 2024, and one-third from a decline in LCV volumes. Switching over to European sales performance, Q1 2025 EU30 market share was 17.3%, an increase of 1.9 percentage points compared to Q4 2024, reflecting in part the sales contributions of recent new product launches.

- Across Stellantis’ “Third Engine”, shipments grew collectively 13 thousand units, representing a 4% increase driven mainly by a 19% increase in South America, more than offsetting shipment declines in Middle East & Africa, China and India & Asia Pacific. Stellantis maintained its leadership in South America while benefiting from higher industry volumes, especially in Brazil and Argentina. In Middle East & Africa the 15% decline in shipments was mostly driven by the impact of import restrictions in Algeria, Tunisia and Egypt.

- Consolidated shipments only include shipments by Company’s consolidated subsidiaries, which represent new vehicles invoiced to third party (dealers/importers or final customers).

Consolidated shipment volumes for Q1 2025 presented here are unaudited and may be adjusted. Final figures will be provided in our official revenue/shipments report. Analysts should interpret these numbers with the understanding that they are preliminary and subject to change. - The “Third Engine” refers to the aggregation of the South America, Middle East & Africa and China and India & Asia Pacific segments for presentation purposes only.