- Net revenues of €74.3 billion, down 13% compared to H1 2024 primarily driven by Y-o-Y declines in North America and Enlarged Europe, partially offset by growth in South America

- Net loss of (€2.3) billion, including €3.3 billion of net charges excluded from Adjusted operating income, down compared to H1 2024 Net Profit of €5.6 billion. AOI of €0.5 billion, with AOI margin of 0.7%, below prior year levels of €8.5 billion and 10.0%, respectively

- Industrial free cash flows of (€3.0) billion, as the subdued level of AOI generation was more than offset by CapEx and R&D expenditures in H1 2025

- Total industrial available liquidity at June 30, 2025 was €47.2 billion, above targeted ratio to Net Revenues

- Total inventories of 1.2 million units (Company inventory of 298 thousand units) at June 30, 2025, +1% compared with year-end 2024, even as new products launched and consolidated shipments rose +5% sequentially

- H1 2025 saw sequential improvement in Shipments, Net revenues, AOI and Industrial free cash flows compared to H2 2024, realizing benefits from an expanded product lineup, revitalized marketing and strong inventory discipline; Net loss deteriorated sequentially

- The Company re-established financial guidance, expects continued sequential improvement in H2 2025

Stellantis N.V. today announced results for the H1 2025, reporting Net revenues of €74.3 billion, down 13% compared to H1 2024. This decline was primarily driven by North America and Enlarged Europe regions, partially offset by growth in South America. Results also reflect the impacts of foreign exchange headwinds, tariffs, and declines in European LCV industry volumes. Despite the challenging financial results, Stellantis is actively positioning itself for a stronger future through strategic leadership changes and renewed focus.

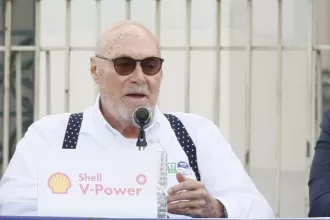

“My first weeks as CEO have reconfirmed my strong conviction that we will fix what’s wrong in Stellantis by capitalizing on everything that’s right in Stellantis – starting from the strength, energy and ideas of our people, combined with the great new products we are now bringing to market. 2025 is turning out to be a tough year, but also one of gradual improvement. Signs of progress are evident when comparing H1 2025 to H2 2024, in the form of improved volumes, Net revenues, and AOI, despite intensifying external headwinds. Our new leadership team, while realistic about the challenges, will continue making the tough decisions needed to re-establish profitable growth and significantly improved results.” Antonio Filosa, CEO

New Leadership Team Now in Place

Stellantis announced on May 28, 2025 that its Board of Directors had unanimously selected Antonio Filosa as its new CEO, effective June 23, 2025. Filosa brings to the CEO role a people-first management philosophy, an expansive track record of success at the Company, and a clear vision for succeeding in a challenging auto industry.

On June 23, 2025 Filosa announced Stellantis’ new leadership team, comprised of individuals with extensive automotive industry expertise. The announcement marked the elevation of several high-performing executives to top-level roles for the first time, with the majority assuming significantly expanded responsibilities.

Filosa was confirmed as a member of the Board of Directors and an executive director of Stellantis at the Extraordinary General Meeting on July 18, 2025.

Commercial Recovery Update – Product Wave in Motion for Further Growth

Commercial recovery actions included the launch of four new models in H1 2025: Citroën C3 Aircross, Fiat Grande Panda, Opel/Vauxhall Frontera, Ram ProMaster Cargo BEV, as well as significant updates to popular products like the Ram 2500 and 3500 Heavy Duty, Citroën C4/C4X and Opel Mokka. New products contributed to a 127-basis points increase in EU30 market share compared to H2 2024, and a significant improvement in North American order books, which can support future period performance.

Stellantis plans to launch 10 new models in 2025, including three STLA Medium products in H2 2025: Jeep® Compass, Citroën C5 Aircross and DS No8, complementing the recently launched STLA Medium-based Peugeot 3008, 5008 and Opel/Vauxhall Grandland.

In direct response to customer feedback, Ram announced the return of the 5.7-liter HEMI® V-8 in the 2026 Ram 1500. The first trucks will arrive at dealerships in H2 2025. The second half of 2025 will also see the return to production for several other iconic products: the hybrid Jeep® Cherokee and the ICE Dodge Charger SIXPACK, each of which has been on production hiatus since 2023. The four-door Charger Daytona also joins the family.

Peugeot announced the comeback of its GTi franchise with a new 208 GTi revealed at the 24 Hours of Le Mans in June 2025.

Additionally, the Fiat Titano pickup truck has been introduced to the Argentine market, with a new engine and transmission, and is now produced at our plant in Córdoba, Argentina.

Tariff Update

Stellantis updates its estimate of 2025 net tariff impact to approximately €1.5 billion, of which €0.3 billion was incurred in H1 2025. The Company remains highly engaged with relevant policymakers, while continuing long-term scenario planning.