- Range Rover clients can now benefit from a new insurance solution for new and used vehicle purchases

- Jaguar Insurance and Land Rover Insurance policies have been developed to help alleviate recent challenges clients have faced when seeking insurance

- Live since October, it has so far provided more than 4,000 clients with a JLR insurance solution, with an average monthly premium of less than £200

- Policies offer clients a fully flexible, monthly subscription model through a seamless experience online

- New insurance offering follows JLR’s £10 million investment in vehicle security to reduce keyless thefts in the UK

- Latest vehicles are proving highly resilient to this organised criminality, reflected in low theft rates: with only 0.07 per cent of Range Rover and 0.1 per cent of Range Rover Sport being affected

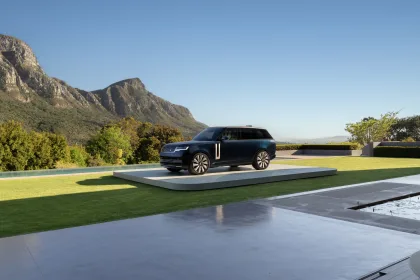

Range Rover clients in the UK can now benefit from a new insurance solution through Land Rover Insurance. The new solution is designed for clients who may be facing challenges with increasing insurance premiums, which are affecting the industry.

Land Rover Insurance will improve the buying and ownership experience for Range Rover clients. Eligible clients can now obtain a quote online and manage their monthly rolling subscription and policy cover in a flexible way, at any time.

The fully comprehensive insurance ensures any repairs are completed by a JLR authorised bodyshop, using only genuine parts. The policy is completely flexible, with no deposits or interest charges, and clients are able to amend or cancel their cover with no fee. The price is also guaranteed for 12 months, for added assurance and peace of mind.

Also available to clients looking to insure Defender and Discovery vehicles, as well as Jaguar clients through Jaguar Insurance, the service has provided quotes to more than 4,000 clients since October, with an average monthly premium of less than £200. JLR has also proactively shared with leading insurance providers its latest data – reflecting the robustness of security in new and older models – to help increase the range of insurance options on the open market.

Customers of luxury cars and other luxury items are experiencing an increase in thefts due to organised criminal activity in the UK. The desirability of our luxury vehicles, coupled with concerns around thefts, has recently led to challenges in obtaining insurance cover for some clients. We are fully committed to doing everything we can to address this by adopting a multifaceted approach: from our significant investment in vehicle security, to now providing our own insurance.

While our new insurance proposition is a key milestone, we want to reassure clients that we will continue monitoring and refining our service so that even more clients can take advantage of it

JLR SPOKESPERSONThe latest vehicles are proving highly resilient to thefts: UK police data shows that since January 2022, only 9 of the 12,200 new Range Rovers on the road have been stolen (0.07 per cent), while only 13 of the 13,400 new Range Rover Sports on the road have been affected (0.1 per cent).

As part of a suite of services to enhance the ownership experience for its clients, JLR announced last month its £10 million investment in vehicle security to help tackle keyless thefts. This included an extensive rollout of security updates benefitting more than 70,000 older vehicles in the UK since the initiative began in 2022, ensuring the same levels of protection against theft as current, new models. This, along with dedicated collaboration with police and partners, is reducing thefts.