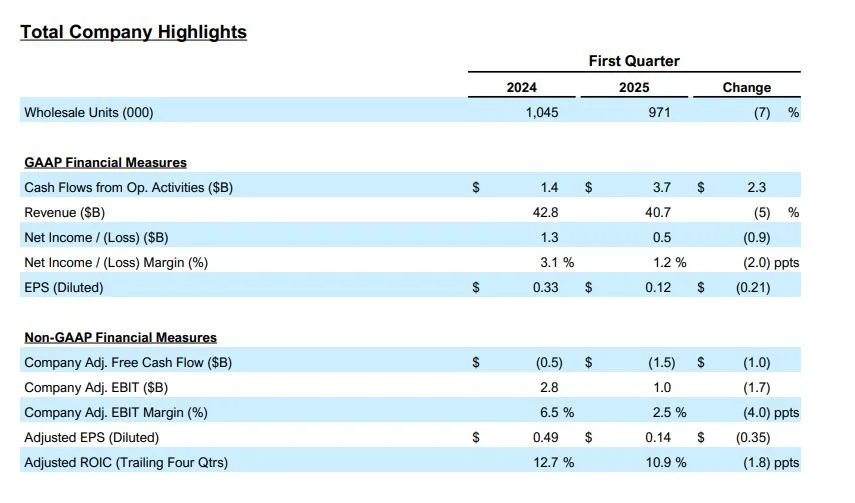

- First-quarter revenue of $40.7 billion; net income of $471 million; adjusted EBIT of $1 billion; operating cash flow was $3.7 billion, adjusted free cash flow was a use of $1.5 billion

- Improvements in cost and quality favorably contributed to performance in the quarter

- The company estimates a tariff-related net adverse adjusted EBIT impact of about

- $1.5 billion for full year 2025, subject to ongoing tariff-related policy developments

- Due to tariff-related uncertainty, company suspends financial guidance, including full year adjusted EBIT and adjusted free cash flow

Ford Motor Company today announced its firstquarter 2025 financial results. “We are strengthening our underlying business with significantly better quality and our third straight quarter of year-over-year cost improvement, excluding the impact of tariffs,” said Ford President and CEO Jim Farley. “Ford Pro, our largest competitive advantage, is off to a strong start to the year, gaining market share in the most profitable U.S. and European customer segments.”

Added Ford CFO Sherry House: “Ford+ is creating a more efficient and durable company including a disciplined approach to capital allocation. Our strong balance sheet, with $27 billion in cash and $45 billion in liquidity, provides flexibility to continue to invest in profitable growth while managing current industry dynamics.”

The company posted first-quarter revenue of $40.7 billion, a 5% decrease from the same period a year ago, as a result of a reduction in wholesales stemming from a planned shutdown in certain plants related to new product launches and inventory rebalancing measures. Net income was $471 million; adjusted earnings before interest and taxes was $1.0 billion.

Cash flow from operations in the first quarter was $3.7 billion, and adjusted free cash flow was a use of $1.5 billion. At the end of the quarter, Ford had $27 billion in cash and $45 billion in liquidity. Additionally, in April, Ford successfully renewed its $18 billion corporate credit facilities for another year.

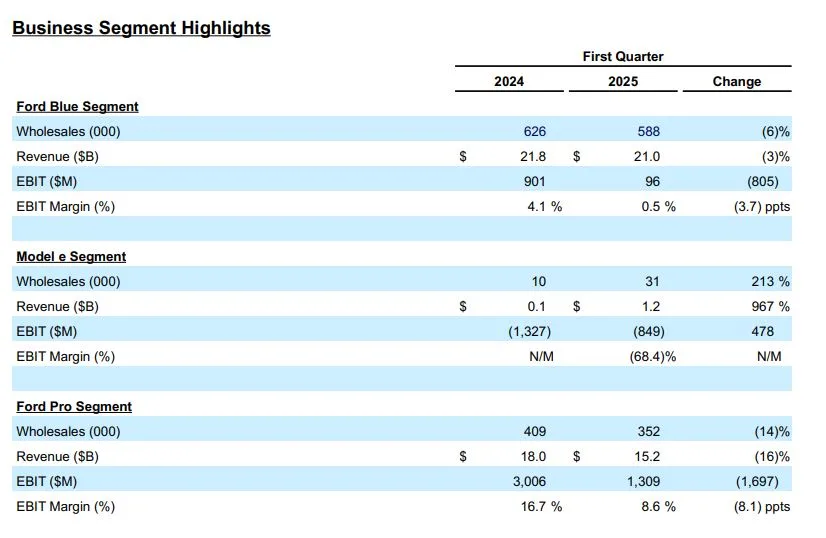

Ford Pro generated $1.3 billion in EBIT with a margin of 8.6% on $15.2 billion in revenue. The EBIT change from a year ago primarily reflects a 14% decline in wholesales due to planned downtime and unfavorable fleet pricing. Ford Pro ended the first quarter with 675,000 paid subscriptions, up 4% sequentially.

Ford Model e reported a first-quarter EBIT loss of $849 million. The segment remains focused on improving gross margins and exercising a disciplined approach to investments in battery facilities and next-generation products. U.S. retail sales grew 15% compared to a year ago as the Ford Power Promise campaign gave more customers access to home chargers and standard installation.

In the first quarter, Ford Blue reported $96 million in EBIT, down from a year ago due to expected volume decline and adverse exchange. Segment revenue declined 3% to $21 billion. Iconic nameplates such as F-Series and Bronco, continue to lead their respective segments.

Ford Credit reported first-quarter earnings before taxes (EBT) of $580 million, up significantly compared to a year ago. In the quarter, Ford Credit paid a $200 million distribution to its parent.

Full-Year 2025 Outlook

Ford’s underlying business is strong – tracking within the previous adjusted EBIT guidance range of $7 billion to $8.5 billion, excluding new tariff-related impacts. Based on what the company knows now, and its expectation of how certain details and changes will be resolved related to tariffs, the company estimates a net adverse adjusted EBIT impact of about $1.5 billion for full-year 2025.

Given material near-term risks, especially the potential for industrywide supply chain disruption impacting production, the potential for future or increased tariffs in the U.S., changes in the implementation of tariffs including tariff offsets, retaliatory tariffs and other restrictions by other governments and the potential related market impacts, and finally policy uncertainties associated with tax and emissions policy, the company is suspending guidance.

These are substantial industry risks, which could have significant impacts on financial results, and that make updating full year guidance challenging right now given the potential range of outcomes. The company will provide an update during the Q2 earnings call.