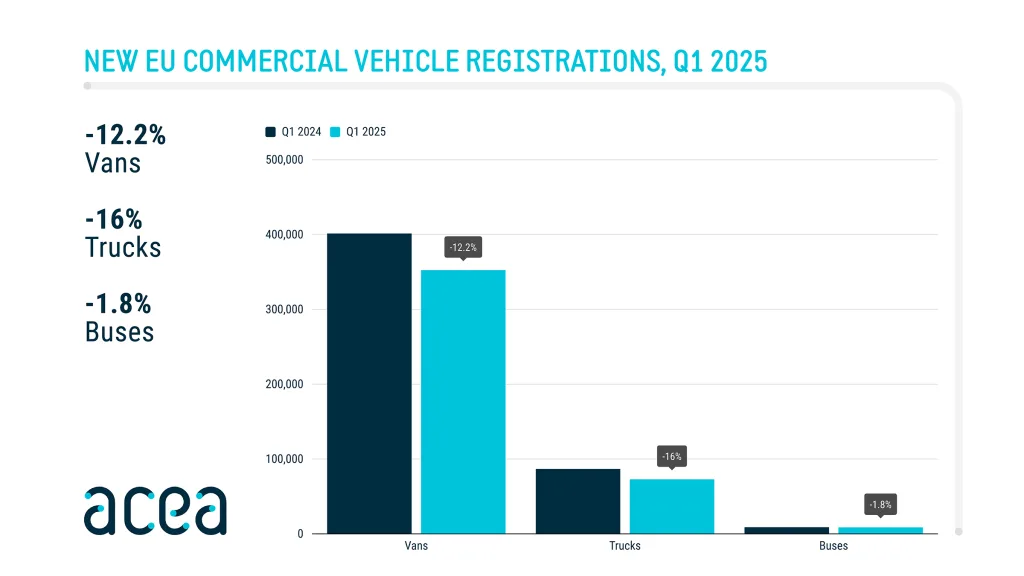

The first quarter of 2025 proved challenging for the EU’s commercial vehicle market, marked by significant declines in key markets. Sluggish economic growth, lower prior order intake, and the complex regulatory landscape contributed to the business uncertainty.

New EU van sales fell by 12.2%, with the three largest markets contributing to the downturn. Italy recorded the steepest drop with a 15.2% decline, followed by France (-10.7%) and Germany (-10.7%). Conversely, Spain saw an increase in registrations, rising by 12.6%.

New EU truck registrations also fell by 16%, totalling 72,941 units. This decline was mainly driven by a 16.6% drop in heavy-truck sales, alongside a 12.5% decrease in medium-truck registrations. All major markets recorded declines, with Germany and France experiencing double-digit reductions of 25.4% and 17.6%, respectively. Spain and Italy also saw significant drops of 12.8% and 9.4%.

New EU bus sales declined by 1.8% compared to Q1 2024, totalling 8,674 units. Among major markets, Germany recorded a sharp decline (-15%), followed by Italy (-7.3%) and Spain (-0.5%). France posted a small increase (+0.1%), while markets like Sweden (+189.9%) and Greece (+187.6%) recorded notable growth.

Vans

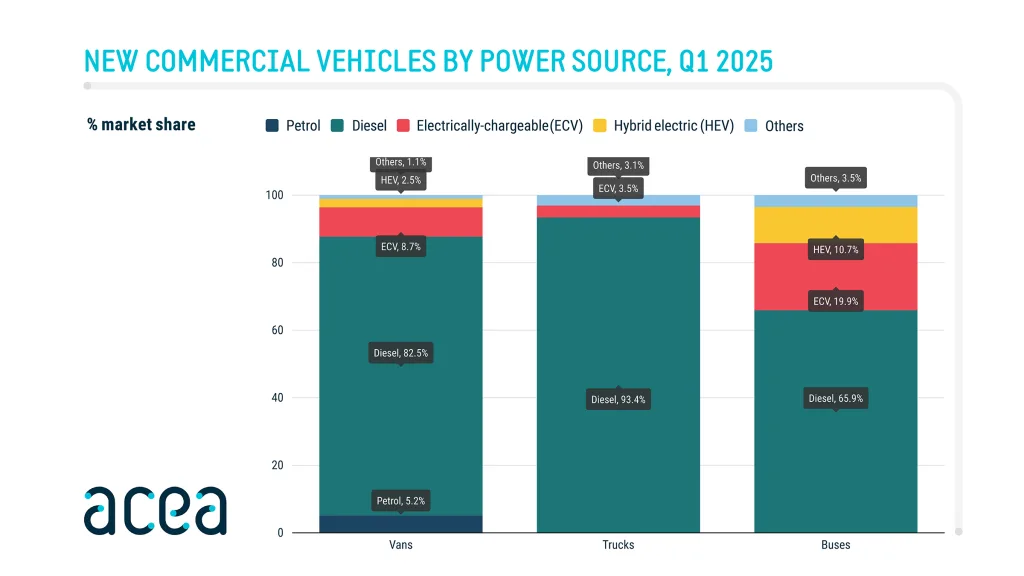

Diesel was the preferred choice for new van buyers in the EU in Q1 2025. However, sales declined by 14% to 290,870 units, resulting in an 82.5% market share (a decrease from 84.2% in Q1 2024). Petrol models decreased by 25.8%, accounting for a 5.2% share. Electrically-chargeable vans grew by 32.6%, capturing an 8.7% market share, an increase from 5.7% in Q1 2024. Hybrid van registrations grew by 0.7%, while only accounting for a 2.5% market share.

Trucks

Diesel maintained its dominance in the truck market in the first quarter of 2025. Diesel trucks accounted for 93.4% of new EU registrations, despite the 17.7% drop in volumes compared to Q1 2024. Electrically-chargeable trucks grew by 50.6%, securing 3.5% of the market share, up from 2% last year. The Netherlands led this expansion with a 342.7% growth, accounting for 25% of the EU’s electrically-chargeable truck sales.

Buses

New EU electrically-chargeable bus registrations surged by 50.3% in the first quarter of 2025, with market share increasing from 13% in Q1 2024 to 19.9%. Germany, the largest market by volume, saw an impressive growth of 118.9%, while Sweden recorded the second-largest number of registrations, 237 electric buses compared to just 9 in Q1 2024. On the other hand, hybrid-electric bus sales experienced a double-digit decline of 28.7%, accounting for 10.7% of the market. Diesel bus registrations declined by 5.6%, now holding a 65.9% market share, down from 68.5% in Q1 2024.