The BMW Group achieved its business objectives for financial year 2023, as forecasted. Despite strong competition and volatile conditions, the company successfully maintained its profitable growth and defended its leading position in the global premium segment: A total of 2,554,183 premium vehicles weredelivered to customers in the year to the end of December (2022: 2,399,632 units / +6.4%) ‒ including 717,620 units in the fourth quarter (Q4 2022: 651,794 units / +10.1%). Deliveries for the full year had a solid increase, resulting in a market share of 3.3%.

High demand for its products was the driver for the BMW Group’s continuing strong financial performance: The Group EBT margin came in at 11.0% (2022: 16.5%; Q4: 8.6%; 2022: 8.2%), above the strategic target of 10%. The EBIT margin in the Automotive Segment of 9.8% (2022: 8.6%; Q4: 8.5%; Q4 2022: 8.5%) was within the forecast target range of 9.0-10.5%.

Throughout 2023, the company’s fresh and attractive range of fully-electric vehicles was a key growth driver. The BMW Group delivered a total of 375,716 fully-electric cars (2022: 215.752 units / +74,1%) to customers, achieving a share of around 15% of total sales, as planned. Including the PHEVs delivered, the BMW Group sold a total of 565,875 electrified vehicles (2022:433,792 units / +30.5%) and thus achieved a sales share of 22%.

The electrification of the vehicle portfolio contributes significantly to CO2 emissions reduction in the Group and also to the continued reduction of CO2 fleet emissions. In the European fleet, the BMW Group continued to reduce emissions in 2023: At 102.1 grams per kilometre of CO 2 (according to WLTP; 2022: 105 g/km / -2.8%), the preliminary figure was significantly below the target set by the European Union of 128.5 grams per kilometre.

“The year 2023 underlined how we are implementing our strategy consistently and successfully. We posted strong growth and substantially increased our percentage of fully-electric vehicles, while improving our operational profitability. A lot of people talk about ‘transformation’. For us, it’s more a question of continuous progress,” said Oliver Zipse, Chairman of the Board of Management of BMW AG, on Thursday. “We are advancing forward with our course – offering our customers the newest innovations and the latest technology, regardless of the vehicle’s powertrain. In this way, we aim to continue to deliver strong products for strong demand.”

Solid increase in Group revenues

Group revenues reported a solid increase in the full year and climbed to € 155,498 million (2022: € 142,610 million / +9.0% / adjusted for currency translation effects: +13.1%).

In the period from January to December 2023, the revenues of BMW Brilliance Automotive Ltd. (BBA) were fully included; in the prior year, this was only the case from 11 February 2022 onwards, following full consolidation. This should be factored into the year-on-year comparison.

In addition to full consolidation, revenues were primarily driven by higher sales volumes and positive product mix effects. Higher interest rates and tailwinds from loan financing also contributed to the growth in revenues – which were impacted by currency headwinds from the Chinese renminbi and the US dollar.

R&D expenses reach new high

Group research and development costs for the full year rose significantly to € 7,538 million (2022: € 6,624 million / +13.8%). In addition to development expenses for new models, like the new BMW 5 Series, the X3 and X5 (model update), Rolls-Royce Spectre* and future models for the NEUE KLASSE, R&D spending was primarily focused on further electrification and digitalisation of the vehicle portfolio and on automated driving.

The R&D ratio (according to the German Commercial Code) for the full year was 5.0% (2022: 5.0%) and therefore at the high end of the company’s long-term target range of 4.0-5.0%.

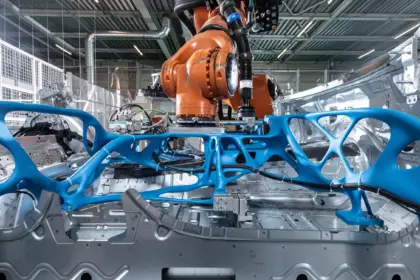

The BMW Group’s capital expenditure increased in the full year to € 8,836 million (2022: € 7,791 million / +8.5%). Substantial investment was channelled into the electrification and autonomous driving modules, as well as setting up high-voltage battery production in various markets and plant construction in Debrecen, Hungary.

The capex ratio for the 12-month period came in at 5.7% (2022: 5.5%).

“We are making major investments in innovative technologies and electrification and digitalisation of our products and plants. We are investing in the future of the BMW Group and generate a strong free cashflow. Our strong financial performance paves the way for this. Our profitability today lays the foundation for our success in the future. Thanks to our highly efficient premium vehicles with leading technology, we aim to maintain our profitable growth in the future,” said Walter Mertl, member of the Board of Management responsible for Finance.

Group earnings (EBIT) significantly higher

The company’s full-year earnings before financial result (EBIT) reflected the BMW Group’s strong operating performance: In 2023, EBIT climbed to € 18,482 million(2022: € 13,999 million / +32.0%). In addition to the full consolidation of BBA and higher vehicle deliveries, lower intersegment eliminations related to the leasing business also had a positive effect.

Between January and December, the BMW Group reported pre-tax earnings (EBT) of € 17,096 million (2022: € 23,509 million / -27.3%). Here, the negative fair value driven financial result of € -1,386 million (2022: € 9,510 million) reflects a corresponding base effect: In the prior year, the revaluation of BBA equity interests of € 7.7 billion, as part of the full consolidation, had significantly increased the BMW Group’s financial result, Group earnings and Group net profit.

The EBT margin for January to December came in at 11.0% (2022: 16.5%).

Group net profit for the 12-month period amounted to € 12,165 million (2022: € 18,582 million / -34.5%). Without the one-time revaluation effect, Group net profit would have been higher year-on-year, with an EBT margin on par with the previous year.

Significant increase in Automotive EBIT in YTD December

In the Automotive Segment,full integration of the operating business of BMW Brilliance Automotive Ltd. (BBA), higher sales volumes and positive product mix effects boosted revenues for the 12-month period by 7.0% to € 132,277 million (2022: € 123,602 million / adjusted for currency translation effects: +11.3%), as did higher revenues from aftersales business. Negative currency translation effects, primarily from the Chinese renminbi and the US dollar, impacted revenue growth: Excluding these headwinds, revenues saw a significant increase of 11.3% for the full year.

Depreciation and amortisation from the purchase price allocation in connection with the full consolidation of about € 1.4 billion impacted the segment’s cost of sales for the full year as well as a slight increase in sales and administrative costs.

The Automotive Segment’s earnings before financial result (EBIT) for the full year were also significantly higher, at € 12,981 million (2022: € 10,635 million / +22.1%). A positive effect came from the full-year inclusion of the BBA result and from the net effect of volume, mix and pricing, driven by the higher sales volume and the higher share of top end as well as BMW M vehicles. However, headwinds resulted from higher research and development spending and increased manufacturing costs against 2022 as well as the higher share of electrified vehicles. The EBIT margin for this period was 9.8% (2022: 8.6%; +1.2 %-pts.). Excluding depreciation and amortisation for BBA assets from the purchase price allocation of € 1.4 billion previously referred to, the EBIT margin was 10.8%.

Thanks to this positive earnings development, the segment’s free cash flow amounted to € 6,942 million at the end of December (2022: € 11,071 million / -37.3%). The previous year included the positive one-time effect of around € 5 billion from the full consolidation of BMW Brilliance.

BMW AG share buyback programme continued

Based on the authorisation issued at the Annual General Meeting in May 2022, the Board of Management made the decision to buy back shares worth up to € 2.0 billion. During the initial share repurchase programme between July 2022 and June 2023, BMW AG repurchased a total of 22,199,529 shares of common stock for

€ 1,850 million and 1,923,871 shares of preferred stock for € 150 million. This is equivalent to 3.78% of the current share capital. In accordance with the Board of Management decision, all shares acquired were retired in the third quarter of 2023.

The second share buyback programme, worth up to € 2.0 billion, got underway in July 2023. By the end of 2023, BMW AG had acquired 4,218,363 shares of common stock and 942,892 shares of preferred stock. A total purchase price (excluding incidental acquisition costs) of around € 500 million was paid for the shares repurchased in this first tranche. This corresponds to 0.81% of the current share capital.

The second share buyback programme continued in January 2024 with the second tranche. As of 12 March 2024, the BMW Group had bought back 7,531,194 shares with a total value of € 734 million and thus holds 1.18% of the current share capital.

The second share buyback programme will be concluded no later than 31 December 2025.

Dividend of € 6.00 proposed

Shareholders will also participate in the success of financial year 2023. Subject to the approval of the Annual General Meeting, thecompany’s unappropriated profit (according to the German Commercial Code) of € 3,802 million (2022: € 5,481 million / -30.6%), representing a preliminary payout ratio of 33.7% (2022: 30.6%), will be distributed to shareholders from BMW AG’s net profit.

Taking into consideration the target range of 30-40% of net profit for the payout ratio attributable to the shareholders of BMW AG, the Board of Management and Supervisory Board will propose a dividend of € 6.00 per share of common stock (2022: € 8.50) and € 6.02 per share of preferred stock (2022: € 8.52) to the Annual General Meeting on 15 May. BMW Group employees will once again participate in the company’s success in an appropriate way.

Stable earnings performance in Financial Services Segment

In the difficult competitive landscape of financial year 2023, BMW Group Financial Services reported slight growth in its volume of new business with retail customers, which increased to € 57,333 million (2022: € 55,449 million / +3.4%). Due to the improved product mix, the average financing volume per vehicle rose. The number of new contracts concluded with retail customers reached the previous year’s level of 1,542,514 (2022: 1,545,490 contracts / -0.2%). At the end of the year, the penetration rate – the percentage of new BMW Group vehicles leased or financed by the Financial Services Segment – stood at 38.2% (2022: 41.0% / –2.8 %-pts.).

In the 12-month period, the segment reported pre-tax earnings of € 2,962 million (2022: € 3,205 million / -7.6%). This decline in earnings mainly resulted from higher refinancing costs and the smaller total portfolio of 4,952,318 retail contracts (31 Dec. 2022: 5,210,246 contracts / -5.0%).

BMW Group Financial Services benefited from continuing high income from the resale of end-of-lease vehicles – although this was less positive year-on-year and therefore had a dampening effect on earnings. Prices for used cars are likely to continue this trend in 2024.

Lower credit risk provisioning compared to the previous year had a positive effect. In 2022, credit risk provisioning had been heavily influenced by geopolitical uncertainties and weaker macroeconomic prospects.

The credit loss ratio for 2023 remained at the low rate of 0.18%.

“The Financial Services segment supports our sales growth with its financing activities and makes a major contribution to earnings. We will be integrating our financial services business even more closely into our sales processes and our ‘customer journey’ going forward. Digitalisation of our processes will play a key role in this. In all areas of the company, digitalisation and AI will contribute to greater efficiency, speed and value creation,” according to CFO Mertl. “Also in view of the upcoming demographic change, these two topics are essential for the BMW Group.”

At 17.2%, return on equity in the Financial Services Segment for financial year 2023 (2022: 17.9% / -0.7%-pts.) was in line with the adjusted guidance of 16-19%.

Motorcycles Segment steps up deliveries again in centenary year

BMW Motorrad celebrated its centenary in 2023 with two limited edition models called “100 years”, three new models and four model updates. In its anniversary year, the segment also achieved a new all-time high, with a total of 209,066 motorcycles and scooters delivered to customers (2022: 202,895 units). This represents a slight increase of 3.0% and confirms expectations for the financial year.

In the 12-month period, BMW Motorrad revenues rose slightly to € 3,214 million (2022: € 3,176 million / +1.2%; adjusted for currency translation effects: +3.2%). The segment EBIT for January to December was € 259 million (2022: € 257 million / +0.8%) and therefore on a par with the previous year. The EBIT margin stood at 8.1% (2022: 8.1%).

BMW Group steers successful course in final quarter of the year

The BMW Group achieved dynamic growth in deliveries and a strong financial performance in the fourth quarter of 2023. It delivered 717,620 premium vehicles to customers (Q4 2022: 651,794 units / +10.1%), including 128,849 fully-electric vehicles (Q4 2022: 87,557 units / +47.1%).

Group revenues saw a solid increase in the fourth quarter to reach € 42,968 million (2022: € 39,522 million / +8.7%). Group research and development costs were higher in the final quarter of the year, at € 2,080 million (Q4 2022: € 1,739 million / +19.7%). The R&D ratio (according to the German Commercial Code) was stable at 5.9% (Q4 2022: 5.8% / +0.1 %-pts.). The BMW Group’s capital expenditure totalled € 3,758 million (2022: € 3,111 million / +20.8%).

Group earnings before financial result (EBIT) of € 4,412 million (2022: € 3,500 million / +26.1%) were significantly higher year-on-year. Group earnings before tax (EBT) rose significantly in the fourth quarter to € 3,682 million (2022: € 3,253 million / + 13.2%). The EBT margin for this period was 8.6% (2022: 8.2%).

Group net profit for the fourth quarter totalled € 2,614 million (2022: € 2,175 million / +20.2%).

Automotive Segment revenues posted solid fourth-quarter growth to reach € 37,283 million (2022: € 34,571 million / +7.8%; adjusted for currency translation effects: +12.2%).

Earnings before financial result (EBIT) showed solid growth in the fourth quarter to € 3,171 million (2022: € 2,932 million / +8.2%). The EBIT margin of 8.5% (2022: 8.5%) remained stable from the previous year, underlining the strong operating performance of the Automotive Segment in the final quarter of the year which showed the seasonally high cost burden.

Solid earnings development in the Automotive Segment resulted in a free cash flow of € 1,183 million in the fourth quarter (2022: € 1,195 million / -1.0%).

In the Financial Services Segment, the penetration rate climbed to 39.5% in the fourth quarter and has therefore maintained its growth trajectory (2022: 37.1% / +2.4 percentage points). The segment’s fourth-quarter pre-tax earnings (EBT) totalled € 511 million (2022: € 533 million / -4.1%). This slight decrease was due to higher refinancing costs and a smaller total portfolio.

Employee numbers higher year-on-year

The BMW Group had 154,950 employees at the end of 2023 (2022: 149,475 / +3.7%). This slight increase in employee numbers was mainly in development and IT, as well as in the BMW Group’s global production network.

Proposed re-election of supervisory board members

With the Annual General Meeting on May 15, 2024, the current mandate of Supervisory Board members Dr. h.c. Susanne Klatten, Stefan Quandt and Dr. Vishal Sikka will come to an end. The Supervisory Board will propose re-electing Dr. h.c. Susanne Klatten, Stefan Quandt and Dr. Vishal Sikka for another four-year mandate.

| The BMW Group – an overview: Full year 2023 | 2023 | 2022 | Change in % | |

| Deliveries to customers | ||||

| Automotive1 | units | 2,554,183 | 2,399,632 | 6.4 |

| BMW | units | 2,252,793 | 2,100,689 | 7.2 |

| MINI | units | 295,358 | 292,922 | 0.8 |

| Rolls-Royce | units | 6,032 | 6,021 | 0.2 |

| Motorcycles | units | 209,066 | 202,895 | 3.0 |

| Employees (as of 31 Dec. 2023) | 154,950 | 149,475 | 3.7 | |

| EBIT margin Automotive Segment | percent | 9.8% | 8.6% | 14.1 |

| EBIT margin Motorcycles Segment | percent | 8.1% | 8.1% | -0.4 |

| EBT margin BMW Group2 | percent | 11.0% | 16.5% | -33.3 |

| Revenues | € million | 155,498 | 142,610 | 9.0 |

| Automotive | € million | 132,277 | 123,602 | 7.0 |

| Motorcycles | € million | 3,214 | 3,176 | 1.2 |

| Financial Services | € million | 36,227 | 35,122 | 3.1 |

| Other Entities | € million | 11 | 8 | 37.5 |

| Eliminations | € million | -16,231 | -19,298 | -15.9 |

| Profit before financial result (EBIT) | € million | 18,482 | 13,999 | 32.0 |

| Automotive | € million | 12,981 | 10,635 | 22.1 |

| Motorcycles | € million | 259 | 257 | 0.8 |

| Financial Services | € million | 3,055 | 3,163 | -3.4 |

| Other Entities | € million | -13 | -203 | -93.6 |

| Eliminations | € million | 2,200 | 147 | – |

| Profit before tax (EBT) | € million | 17,096 | 23,509 | -27.3 |

| Automotive | € million | 12,642 | 18,918 | -33.2 |

| Motorcycles | € million | 258 | 269 | -4.1 |

| Financial Services | € million | 2,962 | 3,205 | -7.6 |

| Other Entities | € million | -100 | 995 | – |

| Eliminations | € million | 1,334 | 122 | – |

| Group income taxes | € million | -4,931 | -4,927 | 0.1 |

| Net profit | € million | 12,165 | 18,582 | -34.5 |

| Earnings per share of common stock | € | 17.67 | 27.31 | -35.3 |

| Earnings per share of preferred stock3 | € | 17.69 | 27.33 | -35.3 |

| 1 Deliveries include the joint venture BMW Brilliance Automotive Ltd., Shenyang. | ||||

| 2 Ratio of Group earnings before taxes to Group revenues. | ||||

| 3 Common/preferred shares. Earnings per share of preferred stock are calculated by distributing the earnings required to cover the additional dividend of € 0.02 per preferred share proportionally over the quarters of the corresponding financial year. | ||||

| The BMW Group – an overview: Q4 2023 | Q4 2023 | Q4 2022 | Change in % | |

| Deliveries to customers | ||||

| Automotive1 | units | 717,620 | 651,794 | 10.1 |

| BMW | units | 631,526 | 566,823 | 11.4 |

| MINI | units | 84,616 | 83,651 | 1.2 |

| Rolls-Royce | units | 1,477 | 1,320 | 11.9 |

| Motorcycles | units | 44,349 | 43,562 | 1.8 |

| Employees (as of 31 Dec. 2023) | 154,950 | 149,475 | 3.7 | |

| EBIT margin Automotive Segment | percent | 8.5% | 8.5% | 0.3 |

| EBIT margin Motorcycles Segment | percent | -7.6% | -9.4% | -19.0 |

| EBT margin BMW Group2 | percent | 8.6% | 8.2% | 4.1 |

| Revenues | € million | 42,968 | 39,522 | 8.7 |

| Automotive | € million | 37,283 | 34,571 | 7.8 |

| Motorcycles | € million | 643 | 691 | -6.9 |

| Financial Services | € million | 9,504 | 9,086 | 4.6 |

| Other Entities | € million | 2 | 2 | 0.0 |

| Eliminations | € million | -4,464 | -4,828 | -7.5 |

| Profit before financial result (EBIT) | € million | 4,412 | 3,500 | 26.1 |

| Automotive | € million | 3,171 | 2,932 | 8.2 |

| Motorcycles | € million | -49 | -65 | -24.6 |

| Financial Services | € million | 606 | 536 | 13.1 |

| Other Entities | € million | 0 | -16 | -100.0 |

| Eliminations | € million | 684 | 113 | – |

| Profit before tax (EBT) | € million | 3,682 | 3,253 | 13.2 |

| Automotive | € million | 3,031 | 3,009 | 0.7 |

| Motorcycles | € million | -53 | -57 | -7.0 |

| Financial Services | € million | 511 | 533 | -4.1 |

| Other Entities | € million | -212 | -263 | -19.4 |

| Eliminations | € million | 405 | 31 | – |

| Group income taxes | € million | -1,068 | -1,078 | -0.9 |

| Net profit | € million | 2,614 | 2,175 | 20.2 |

| Earnings per share of common stock | € | 3.77 | 3.43 | 9.9 |

| Earnings per share of preferred stock3 | € | 3.78 | 3.44 | 9.9 |

| 1 Deliveries include the joint venture BMW Brilliance Automotive Ltd., Shenyang | ||||

| 2 Ratio of Group earnings before taxes to Group revenues. | ||||

| 3 Common/preferred shares. Earnings per share of preferred stock are calculated by distributing the earnings required to cover the additional dividend of € 0.02 per preferred share proportionally over the quarters of the corresponding financial year. | ||||