- Third-quarter revenue rises 11% year-over-year to $44 billion; net income of $1.2 billion compares to a year-ago loss of $827 million; adjusted EBIT increases to $2.2 billion

- Delighting Ford Pro commercial customers with leading vehicles and services produces higher revenue, significantly better EBIT and double-digit EBIT margin

- Ford Blue again shows the strength and durable upside of its gas and hybrid vehicles, with higher revenue, EBIT and EBIT margin

- Ford Model e reports 44% higher shipments of electric vehicles, 26% revenue growth; operating loss exacerbated by EV price pressure

- Ford withdraws 2023 guidance with ratification of tentative U.S. labor agreement pending

Ford’s third-quarter 2023 results illustrated how the company is beginning to fulfill the growth potential of the customer-focused Ford+ plan – and underscored the vital role of higher quality and lower costs in driving profitability.

“I’m very optimistic about the reality we’re creating with Ford+,” said President and CEO Jim Farley. “We’re building a more dynamic, highly talented and customer-focused company at the intersection of great vehicles, iconic brands, innovative software and high-value services.

“We’re also radically changing how we work with a series of actions that put the right people with the right capabilities in the right places across the organization, so that our promise isn’t masked by cost and quality issues.”

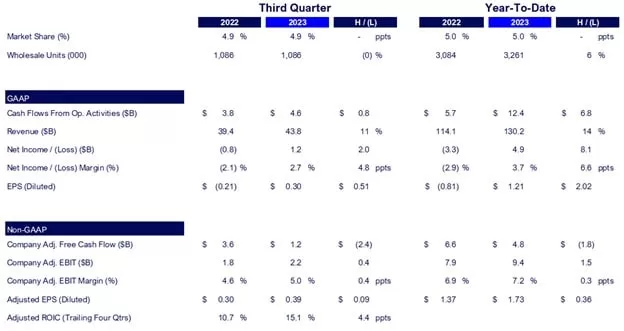

Company Key Metrics Summary

Ford posted third-quarter U.S. sales gains across its gas, hybrid and electric vehicle lines; widened the lead of F-Series as America’s No. 1 truck, now well into the 47th straight year; and was the top-selling brand in the United States through the first nine months of 2023.

Company revenue in the quarter was $44 billion, up 11% from third-quarter 2022 on flat vehicle wholesales. Net income of $1.2 billion reversed a year-ago net loss of $827 million. The latter included a $2.7 billion non-cash, pretax impairment on Ford’s investment in Argo AI. Adjusted earnings before interest and taxes, or EBIT, in Q3 increased to $2.2 billion.

Cash flow from operations was $4.6 billion in the quarter and $12.4 billion through the first nine months of the year. Adjusted free cash flow for the same periods was $1.2 billion and $4.8 billion, respectively.

Ford’s balance sheet remains strong, with more than $29 billion in cash and $51 billion in liquidity at the end of Q3, providing important financial flexibility. That included a $4 billion contingent liquidity facility that the company secured in August in anticipation of business uncertainties.

To attack quality and cost issues, Ford last week completed a sequence of organizational changes in support of Ford+, creating an end-to-end global industrial system under Kumar Galhotra, who was named chief operating officer.

The system – comprising vehicle engineering and cycle planning, gas and hybrid programs, supply chain management, and manufacturing – is expected to be an effective and efficient operational engine for all three auto business segments: Ford Blue, Ford Model e and Ford Pro.

Farley said that Galhotra’s organization together with Doug Field’s EVs, Digital and Design team “will support the businesses and their customers with great technologies and products, while raising quality, reducing costs and rooting out waste with a vengeance.”

Business Segment Highlights

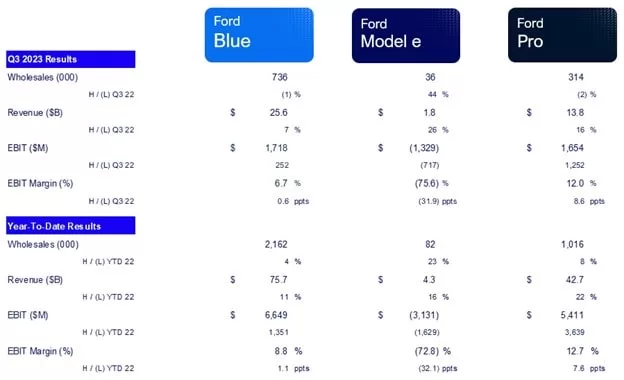

Ford Pro helps commercial customers transform their operations with great gas, hybrid and electric vehicles and a growing array of value-added services. In the third quarter, the business generated $1.7 billion in EBIT – a 12% margin – on $13.8 billion in revenue, which was up 16%.

Through the first three quarters of the year, Ford Pro gained nearly two points of share in the U.S. commercial truck and van market on the continued strength of its Super Duty truck and Transit van franchises. In Europe, the company is launching an all-new version of the Transit Custom van, the company’s flagship business-related vehicle in the region.

Ford Pro’s software subscriptions and mobile repair orders both increased sharply.

Ford Blue, which markets a lineup of gas and hybrid vehicles Farley calls “the best I’ve seen,” delivered $1.7 billion in third-quarter EBIT – up 17% from last year. The business was again profitable in every region where it operates, driven by a strong and fresh product portfolio.

Last month, Ford Blue revealed gas and hybrid versions of the 2024 F-150 pickup, which combines “Built Ford Tough” with power and smarts – the most connected and technologically capable F-150 yet. Third-quarter sales of hybrid vehicles jumped more than 40%, led by F-150 and Maverick trucks. F-150 hybrid volumes were up 47% from a year ago; hybrids now account for 57% of all Maverick trucks sold.

Ford Blue is rolling out new derivatives of its iconic nameplates, which are hugely popular with customers and generate superior revenue and margins. They include the forthcoming Ranger Raptor pickup, Mustang GTD super-car and track variants, and new extensions of the Bronco and Maverick nameplates.

Third-quarter wholesales of Ford Model e’s first-generation electric vehicles increased 44% and revenue was up 26%. The segment recorded an EBIT loss of $1.3 billion, attributable to continued investment in next-generation EVs and challenging market dynamics.

According to the company, many North America customers interested in buying EVs are unwilling to pay premiums for them over gas or hybrid vehicles, sharply compressing EV prices and profitability. Partly in response, Ford this month introduced the F-150 Lightning Flash pickup, combining popular technology-based features in a competitively priced electric truck.

“Ford is able to balance production of gas, hybrid and electric vehicles to match the speed of EV adoption in a way that others can’t,” said CFO John Lawler. “That’s obviously good for customers, who get the products they want – and good for us, too, because disciplined capital allocation and not chasing scale at all costs maximizes profitability and cash flow.”

All Ford customers will benefit over time from newly imagined, developed and delivered software-enabled services. During the third quarter, total paid software subscriptions were up more than 50% year-over-year and are now approaching 600,000.

In August, the company announced that former Apple veteran Peter Stern would establish and lead Ford Integrated Services. Stern’s team will market high-value services leveraging technologies such as the Ford BlueCruise advanced driver-assistance system – with which customers have now driven more than 125 million hands-free miles – and in areas like productivity, security, and next-generation buying and service experiences.

Quarterly earnings before taxes for Ford Credit were $358 million – down from a year ago, as expected, because of lower lease residuals and financing margin, along with a nonrecurrence of gains in derivative market valuations.

Full-Year 2023 Guidance Withdrawn Pending Ratification of Tentative U.S. Labor Agreement

Through the third quarter, Ford earned $9.4 billion in adjusted EBIT toward the full-year range of $11 billion to $12 billion it affirmed in late July. Based on that and strong demand for Ford’s products, Lawler said that the company had been poised to deliver profitability within that range. However, given effects of the UAW strike and with ratification of the tentative agreement with the union that was announced Wednesday night pending, Ford is withdrawing its guidance for full-year 2023 operating results.

Ford plans to report fourth-quarter and full-year 2023 financial results on Thursday, Feb. 1.