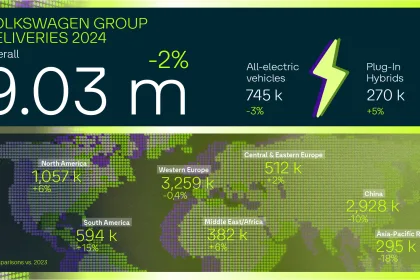

The Volkswagen Group expects deliveries to customers to be around 9 million vehicles (2023: 9.24 million vehicles). The company expects Group sales revenue to be around 320 billion euros (2023: 322.3 billion euros).

Key Figures

237.3 billion sales revenue in 9M 2024, slightly up from 9M 2023 (EUR 235.1 billion)

Group sales revenue up slightly year-on-year due to volume-related increases in the Financial Services business. Sales revenue in the automotive business was 1% below the prior-year level due to lower volumes.

12.9 billion Operating Result in 9M 2024, 21% below 9M 2023 (EUR 16.2 billion); Operating Margin of 5.4%

Operating Result impacted by Brand Group Core performance and significant restructuring expenses of EUR 2.2 billion, mainly at Brand Group Core and Brand Group Progressive as well as higher fixed costs and expenses for the introduction of new products; underlying Operating Margin at 6.5%.

3.3b illion Net Cash Flow in the Automotive Division in 9M 2024 (EUR 4.9 billion)

9M 2024 Net Cash Flow down 34% over last year period; solid Q3 2024 Net Cash Flow supported by release of working capital.

6.5 million vehicle sales in 9M 2024, down 4% compared to 9M 2023 (6.8 million)

Vehicle sales growth in North America (+4%) and South America (+16%) was offset by declines in Western Europe (-1%) and particularly in China (-12%).

+9% order intake for vehicles in Western Europe in 9M 2024 y-o-y

New models well received by the markets, strong momentum in Q3 in Western Europe with 27% more orders y-o-y.

Outlook for 2024 as per ad hoc release from Sep 27, 2024

The Volkswagen Group expects deliveries to customers to be around 9 million vehicles (2023: 9.24 million vehicles). The company expects Group sales revenue to be around 320 billion euros (2023: 322.3 billion euros).

In terms of operating result, the company expects to achieve around 18 billion euros (corresponding to an operating return on sales of around 5.6%).

In the Automotive Division, the Group expects the net cash flow to reach around 2 billion euros. This forecast includes the assumption of cash outs for M&A activities in the amount of around 3.5 billion euros, of which approximately 2 billion euros is attributable to cash out in connection with the planned joint venture with Rivian. Net liquidityin the Automotive Division is expected to be in the range of 36 to 37 billion euros in 2024.

Further information on the brand groups

Core

Sales revenue at prior year level; Operating Margin decreased to 4.4% mainly due to higher fixed costs and restructuring expenses. Underlying Operating Margin before restructuring expenses at 5.2%.

Progressive

Strong decline in sales revenue driven by supply chain shortages; Operating Margin declines to 4.5%; Operating Margin before restructuring expenses and valuation effects at ~8%.

Sport Luxury

Strong decline in sales revenue driven by the challenging macroeconomic environment and the comprehensive renewal of the product portfolio; Operating Margin declines to 14.6% due to negative effects from lower volumes on fixed cost absorption and higher fixed costs.

TRATON Trucks

Continued strong earnings momentum despite softer demand and vehicle sales; Operating Margin came in at 9.0% supported by improved cost structure.

CARIAD

CARIAD sales revenue increases driven by stronger demand for software licenses. The Operating Result was below previous year’s level due to development costs.

Group Mobility

Financial Services recorded a slight increase of contract volume; credit loss ratio remains stable and on solid level. Continued normalization of used car prices; Operating Result of EUR 2.2 billion.

Key Figures Volkswagen Group

| Q3 | 9M | ||||||

| 2024 | 2023 | % | 2024 | 2023 | % | ||

| Volume Data1 in thousands | |||||||

| Deliveries to customers (units) | 2,176 | 2,343 | –7.1 | 6,524 | 6,715 | –2.8 | |

| Vehicle sales (units) | 2,122 | 2,314 | –8.3 | 6,463 | 6,762 | –4.4 | |

| Production (units) | 2,025 | 2,173 | –6.8 | 6,632 | 6,864 | –3.4 | |

| Employees (on Sep 30, 2024/ Dec. 31, 2023) | 684.3 | 684.0 | +0.0 | ||||

| Financial Data (IFRS), € million | |||||||

| Sales revenue | 78,478 | 78,845 | –0.5 | 237,279 | 235,102 | +0.9 | |

| Operating result | 2,855 | 4,894 | –41.7 | 12,907 | 16,241 | –20.5 | |

| Operating return on sales (%) | 3.6 | 6.2 | 5.4 | 6.9 | |||

| Earnings before tax | 2,356 | 5,801 | –59.4 | 12,523 | 17,700 | –29.2 | |

| Return on sales before tax (%) | 3.0 | 7.4 | 5.3 | 7.5 | |||

| Earnings after tax | 1,576 | 4,347 | –63.7 | 8,917 | 12,868 | –30.7 | |

| Automotive Division2 | |||||||

| Cash flows from operating activities | 9,517 | 7,996 | +19.0 | 20,442 | 21,733 | –5.9 | |

| Cash flows from investing activities attributable to operating activities3 | 6,111 | 5,528 | +10.5 | 17,165 | 16,795 | +2.2 | |

| Net cash flow | 3,406 | 2,468 | +38.0 | 3,277 | 4,938 | –33.6 | |

| Net liquidity at Sep 30/Dec. 31 | 34,416 | 40,289 | –14.6 | ||||

| Investment ratio | 13.1 | 14.1 | 13.6 | 12.5 | |||

1) The figures also include the equity-accounted Chinese joint ventures. Prior-year deliveries have been updated to reflect subsequent statistical trends.

2) Including allocation of consolidation adjustments between the Automotive and Financial Services divisions.

3) Excluding acquisition and disposal of equity investments: Q3 EUR 5,966 (5,630) million, January to September EUR 16,708 (16,284) million.

Key figures by brand group and business field from January 1 to September 30

| Vehicle sales | Sales revenue | Operating result | Operating margin | |||||

| Thousand vehicles/€ million | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 |

| Core brand group | 3,627 | 3,575 | 101,523 | 101,060 | 4,491 | 4,985 | 4.4 | 4.9 |

| Progressive brand group | 800 | 945 | 46,262 | 50,390 | 2,088 | 4,595 | 4.5 | 9.1 |

| Sport Luxury brand group1 | 221 | 250 | 25,899 | 27,785 | 3,771 | 5,232 | 14.6 | 18.8 |

| CARIAD | – | – | 652 | 544 | –2,058 | –1,728 | – | – |

| Battery | – | – | 1 | 2 | –371 | –234 | – | – |

| TRATON Commercial Vehicles | 246 | 250 | 34,266 | 33,349 | 3,097 | 2,662 | 9.0 | 8.0 |

| MAN Energy Solutions | – | – | 3,136 | 2,876 | 255 | 292 | ||

| Equity-accounted companies in China2 | 1,903 | 2,150 | – | – | – | – | ||

| Volkswagen Group Mobility | – | – | 40,959 | 37,595 | 2,113 | 2,535 | ||

| Other3 | –335 | –408 | – 15,419 | –18,499 | –479 | –2,098 | ||

| Volkswagen Group | 6,463 | 6,762 | 237,279 | 235,102 | 12,907 | 16,241 | 5.4 | 6.9 |

1) Including Porsche Financial Services: sales revenue EUR 28,564 (30,132) million, operating result EUR 4,035 (5,501) million.

2) The sales revenue and operating result of the equity-accounted companies in China are not included in the consolidated figures; the share of the operating result generated by these companies amounted to EUR 1,179 (1,880) million.

3) In the operating result, mainly intragroup items recognized in profit or loss, in particular from the elimination of intercompany profits; the figure includes depreciation and amortization of identifiable assets as part of purchase price allocation, as well as companies not allocated to the brands.