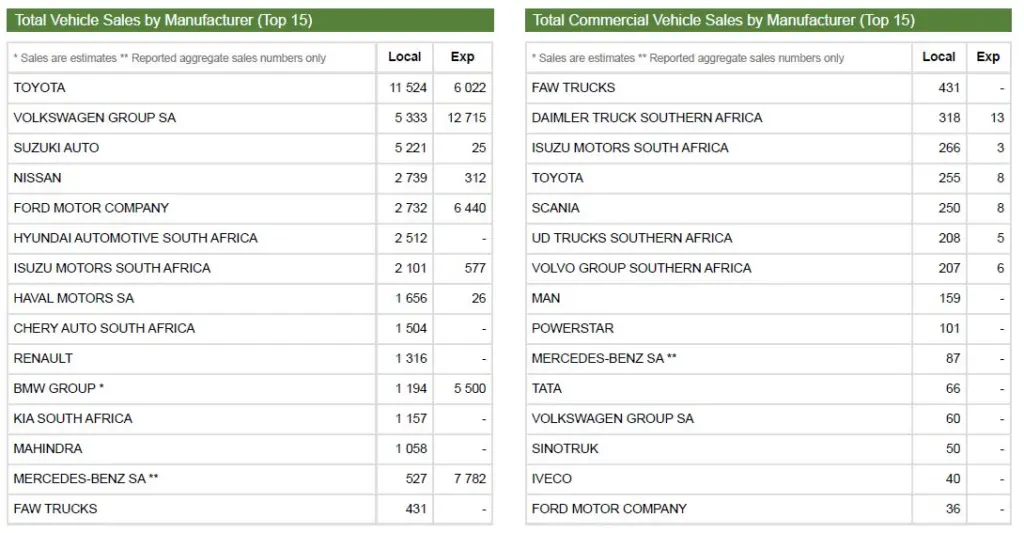

Reflecting on the new vehicle sales statistics for the month of February 2024, naamsa | The Automotive Business Council said that, in line with industry expectations of an anticipated tough first half of the year, the new vehicle market’s declining trend continued in February 2024. Aggregate domestic new vehicle sales in February 2024, at 44,749 units, reflected a decline of 413 units, or a fall of 0,9%, from the 45,162 vehicles sold in February 2023. Export sales recorded a sound increase of 8,526 units or 27,5%, to 39,517 units in February 2024 compared to the 30,991 vehicles exported in February 2023.

Overall, out of the total reported industry sales of 44,749 vehicles, an estimated 37,913 units, or 84,7%, represented dealer sales, an estimated 9,6% represented sales to the vehicle rental industry, 3,4% to government, and 2,3% to industry corporate fleets.

The February 2024 new passenger car market at 28,857 units had registered a decline of 925 cars, or a loss of 3,1%, compared to the 29,782 new cars sold in February 2023. Car rental sales accounted for 12,9% of new passenger vehicles sales during the month.

Domestic sales of new light commercial vehicles, bakkies and mini-buses at 13,306 units during February 2024 had recorded an increase of 328 units, or a gain of 2,5%, from the 12,978 light commercial vehicles sold during February 2023.

Sales for medium and heavy truck segments of the industry reflected a mixed performance for February 2024 at 645 units and 1,941 units, respectively, which is a decline of 54 units, or 7,7% from the 699 units sold in February 2023 in the case of medium commercial vehicles, and, in the case of heavy trucks and buses an increase of 238 vehicles, or 14,0%, compared to the 1,703 units sold in the corresponding month last year.

The February 2024 exports sales number at 39,517 units reflected an increase of 8,526 vehicles, or 27,5%, compared to the 30,991 vehicles exported in February 2023.

The persisting economic strain remain a real concern for household income and the weak new vehicle market reflects that middle-income households are restricting big financial commitments for items such as vehicles at present. The ripple effect of higher interest rates, higher fuel prices and no relief for personal income-taxpayers in the 2024/2025 tax year would continue to impact household incomes for the foreseeable future. With the date of the 2024 South African general election announced to take place on Wednesday, 29 May 2024, economic uncertainty remains the reality for most households and businesses.

Brands and dealerships are currently offering enticing incentives to prospective buyers, but it is anticipated that only once the interest rate cutting cycle commences, likely during the second half of the year, along with easing inflation, some upward momentum would be sparked in the new vehicle market.

Vehicle exports continued their upward trend during February 2024. The trade arrangements enjoyed by South Africa remain essential for the country’s export-oriented automotive industry as they continue to enhance exports to the EU, the UK, SADC, and the US. Europe continued to dominate as a region and accounted for 301,640 units, or 75,5%, of the record 399,594 vehicles exported in 2023. Both advanced and emerging economies are likely to see modest economic growth in 2024, which would support the South African automotive industry’s export performance.

naamsa CEO, Mikel Mabasa again said he welcomed the announcement made by the Minister of Finance, Enoch Godongwana during his Annual Budget Speech 2024 to support the transition to electric vehicles

[EVs] through a strategic and investment driven plan.

“A notable component of the Minister’s announcement is the introduction of an investment allowance for new EV investments, set to commence in March 2026. This allowance enables businesses and investors involved in EV production to claim 150% of qualifying investment spending in the first year. This financial incentive is a crucial step in attracting investments, fostering innovation, and driving the growth of the EV sector within South Africa. The industry will continue to engage with Government to carefully manage some of the challenges associated with the implementation of the APDP2, especially concerning vehicles with limited local content due to the predominant location of battery production in Japan, South Korea, and China. In the short-term, the existence of low local content necessitates Government’s consideration to support other key technologies such as traditional hybrids and plug-in hybrids”, Mabasa said.